Everything about Estate Planning Attorney

Everything about Estate Planning Attorney

Blog Article

Estate Planning Attorney - An Overview

Table of Contents8 Simple Techniques For Estate Planning AttorneyMore About Estate Planning AttorneyThe smart Trick of Estate Planning Attorney That Nobody is DiscussingWhat Does Estate Planning Attorney Mean?

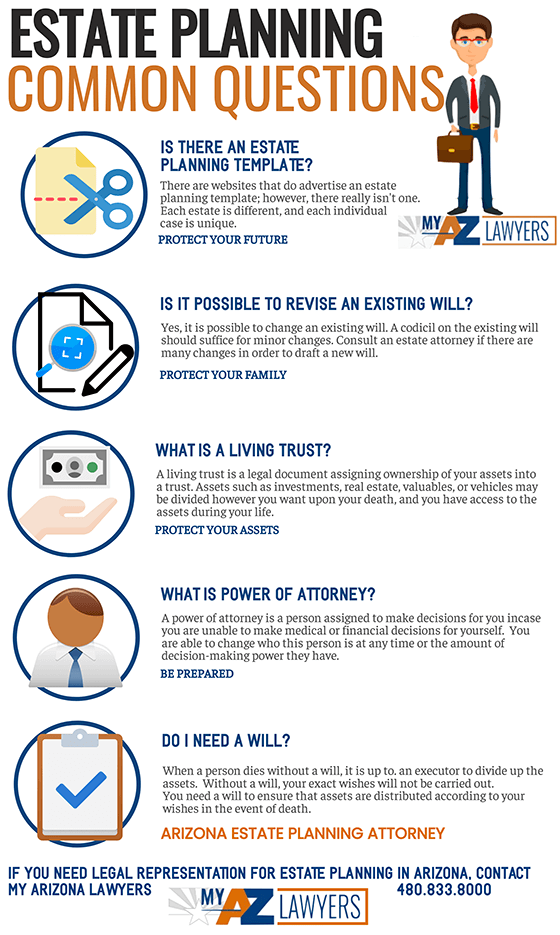

Estate planning is an activity strategy you can make use of to identify what occurs to your assets and commitments while you live and after you die. A will, on the various other hand, is a legal paper that describes exactly how assets are dispersed, who deals with youngsters and pets, and any kind of various other dreams after you pass away.

Insurance claims that are declined by the administrator can be taken to court where a probate judge will certainly have the last say as to whether or not the insurance claim is valid.

Unknown Facts About Estate Planning Attorney

After the supply of the estate has been taken, the value of assets determined, and tax obligations and financial debt paid off, the administrator will then seek authorization from the court to distribute whatever is left of the estate to the beneficiaries. Any type of estate tax obligations that are pending will certainly come due within nine months of the date of fatality.

Each private locations their possessions in the count on and names somebody aside from their partner as the beneficiary. Nevertheless, A-B counts on have actually become less prominent as the estate tax obligation exemption functions well for most estates. Grandparents might move assets to an entity, such as a 529 strategy, to support grandchildrens' education and learning.

Some Known Facts About Estate Planning Attorney.

Estate planners can collaborate with the benefactor in order to decrease gross income as an outcome of those payments or develop techniques that take full advantage of the impact of those contributions. This is an additional method that can be made use of to limit fatality tax obligations. It includes a private securing the existing worth, and thus tax obligation, of their residential property, while connecting the worth of future development of that funding to an additional individual. This approach involves cold the value of a property at its value on the date of transfer. As necessary, the amount of possible resources gain at fatality is also frozen, permitting the estate organizer to approximate their prospective tax obligation obligation upon fatality and much better strategy read this post here for the payment of revenue tax obligations.

If adequate insurance earnings are readily available and the policies are correctly structured, any revenue tax on the considered personalities of assets adhering to the death of an individual can be paid without resorting to the sale of assets. a knockout post Earnings from life insurance policy that are gotten by the beneficiaries upon the death of the guaranteed are typically income tax-free.

There are particular documents you'll require as part of the estate preparation procedure. Some of the most typical ones include wills, powers of lawyer (POAs), guardianship designations, and living wills.

There is a misconception that estate preparation is only for high-net-worth individuals. That's not real. Estate planning is a device that every person can utilize. Estate planning makes it much easier for people to establish their wishes prior to and after they die. Unlike what lots of people believe, it expands beyond what to do with properties and published here responsibilities.

10 Easy Facts About Estate Planning Attorney Described

You ought to start planning for your estate as quickly as you have any quantifiable asset base. It's a recurring process: as life advances, your estate strategy need to move to match your conditions, according to your brand-new objectives. And maintain at it. Refraining your estate preparation can create excessive monetary problems to loved ones.

Estate preparation is often thought of as a tool for the rich. Estate planning is likewise an excellent way for you to lay out strategies for the care of your minor youngsters and family pets and to outline your wishes for your funeral and favorite charities.

Eligible applicants who pass the examination will be formally certified in August. If you're eligible to rest for the test from a previous application, you might file the short application.

Report this page